Intel Cancels Plans to Acquire Sensor and Semiconductor Maker Tower

Intel is walking away from its plans to acquire Tower Semiconductor, a chip and CMOS sensor manufacturer that Panasonic once owned a major stake in.

Intel is walking away from its plans to acquire Tower Semiconductor, a chip and CMOS sensor manufacturer that Panasonic once owned a major stake in.

"Crop factor" is a term that is often heard in the world of digital photography, especially when discussing entry-level cameras. If you have no idea what it means, this article is a basic explanation that should help to fill you in.

Intel has announced that it will purchase camera sensor manufacturer Tower Semiconductor (formerly TowerJazz as of March, 2020) in a deal worth $5.4 billion.

Manufacturing silicon is patently not required in order to make cameras -- anyone can put together a pinhole model -- however, the wider point is more pertinent. To be a competitive, global, manufacturer, do you need to make the sensors that actually go into camera bodies?

OmniVision Technologies claims to have developed the first image sensor with 100% phase detection autofocus (PDAF) coverage designed for smartphones. The company says its new 50-megapixel sensor allows for improved distance calculation, faster autofocus, and better low-light performance.

Samsung Electronics is reportedly in a position to challenge Sony's imaging sensor dominance. Sony had prioritized the supply of image sensors to Huawei, a strategy that has backfired; Samsung is apparently ready to take advantage.

Sony has released an official "statement regarding the impact of the spread of the novel coronavirus," in which the company details exactly how the COVID-19 pandemic has impacted each of their businesses. As expected, the news is pretty negative across the board.

Activist investor Daniel Loeb is reportedly using the current low stock prices to build a bigger stake in Sony and "push for changes," including spinning off the brand's image sensor business into a separate entity called Sony Technologies.

Sony is warning investors that the Coronavirus outbreak in China could have a major impact on its image sensor business, saying that production of both image sensor and electronics "could be affected enormously" if the virus continues to progress.

After a Nikkei report (and, later, an official press release) revealed that Panasonic would officially be selling off its semiconductor business, many people wondered what would happen to the joint venture with TowerJazz that constituted Panasonic's image sensor business. Now we know.

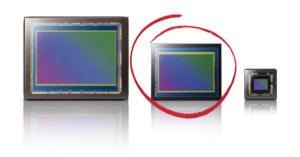

Like it or not, much of the conversation around image quality these days revolves around sensor size. When Sony announced the a7R IV, it boasted image quality that “rivaled medium format.” When people defend Micro Four Thirds, they show off their ultra-portable system and claim the images are “indistinguishable from full-frame.”

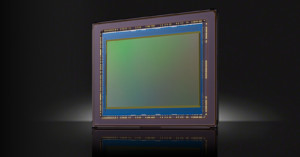

Sony recently published the spec sheets for six of its full-frame sensors, including a quad-bayer version of the 61MP chip found inside the Sony a7R IV. Given the ubiquity of Sony's BSI-CMOS sensors, it's possible we'll see tweaked versions of these sensors in some next generation full-frame cameras.

One of Sony's crown jewels in its empire is its image sensor business, which dominates global market share and has helped the company hit record profits. But now a famous investor is calling for Sony to spin-off the sensor business into a completely independent company.

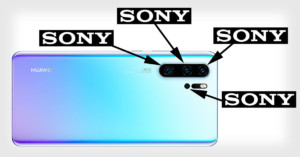

Huawei's new P30 Pro smartphone has jaw-dropping low-light abilities and industry-leading image quality. The company has been touting its quad camera system as being co-engineered by Leica, but here's an interesting piece of info that isn't being widely publicized: all the imaging sensors were made by Sony.

Sony is the 800-pound gorilla of camera sensors these days, boasting a global market share of around 50% in late 2017, but increased competition may be looming on the horizon. Samsung is reportedly ramping up its image sensor production capacity with a goal of overtaking Sony for the #1 spot.

Five years ago, after seeing losses of $2.9 billion, Sony announced that it would be focusing its efforts on dominating three things: games, mobile, and image sensors. Well, the company just announced record quarterly profits and its ambitious plans for global sensor domination are still alive and well.

Sony is one of the heavyweights in the camera sensor business and a company that produces sensors for rival camera companies, including Nikon. But when it comes to Sony's best sensor designs, the company apparently keeps those precious sensors exclusively in-house for its own cameras.

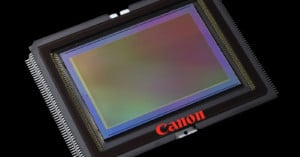

Sony has become the world leader in image sensor production in recent years by supplying the sensors to third-party companies. Canon, however, has been content with using its sensors solely in-house on its own cameras and products. That's set to change: Canon is now planning to supply Canon-made CMOS sensors to other companies for the first time in the company's history.

Sony's image sensor business has seen meteoric growth in recent times, but it seems that things are now cooling down. The company just reported its earnings for its latest quarter, and things aren't looking as rosy as they were before: Sony reports a "significant" decrease in image sensor sales.

Sony announced a few years ago that digital imaging would be one of its three main pillars (with the other two being games and mobile). It looks like the decision is paying off, and Sony is doubling down on its plans. After making 40% of all image sensors sold in 2014, Sony is now announcing that it will raise $4 billion in funding in order to increase how many sensors it can produce.

Sony may not make the world's most popular smartphones or cameras, but it's playing a bigger role in those industries than what meets the eye: the company's image sensor business has been booming in recent years. In 2014, Sony was the company that made 40% of all the sensors sold across the globe.

Tech company Rambus just announced "Binary Pixels," a new sensor technology that intends to bring ultra-high dynamic range to small sensors like those found in smartphones and P&S cameras. By allowing pixels to "reset" and saturate more than once, the pixel tech promises to expand the dynamic range of these sensors to "single-shot HDR" levels.

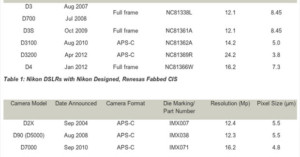

Electronics reverse-engineering company Chipworks has published an article that discusses and reviews Nikon’s …

With each new generation of popular digital camera lines, consumers generally expect that feature upgrades also be accompanied by improvements to the image sensor. According to camera testing service DxOMark, that's not the case with Canon's entry level DSLR lineup.

Update: Apparently they’ve decided to not allow external embedding of this promo video… You can watch it …

When German image sensor scientist Joachim Linkemann gave a talk called “Advanced Camera and Image Sensor Technology” at Automate …